rental income tax malaysia

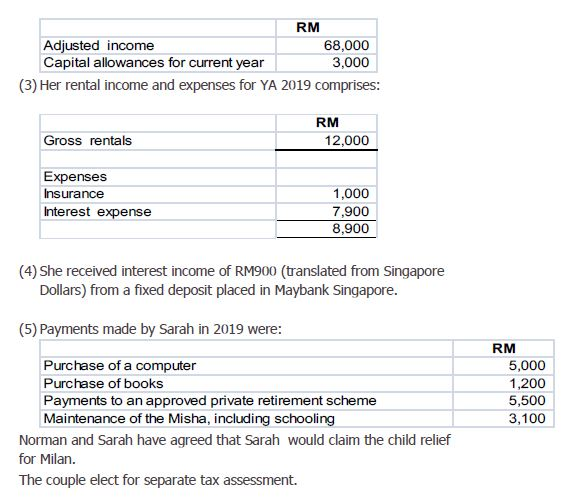

Tax season will be coming up soon for Malaysians making an income of at least RM34000 for the Year of Assessment YA 2021. Tax is assessed on annual rentals and other income received from the real property after deduction of related expenses.

5 Tax Considerations When Selling Off Your Property Iproperty Com My

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually.

. How To Pay Your Income Tax In Malaysia. Income from Immovable Property. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Income tax exemption on rental income from the first year of assessment statutory income is derived until year of assessment 2026 and. But you are delinquent on a student loan and have 1000 outstanding. Those who have received their Income Tax Return EA Form can do this on the ezHASiL portal by logging in or registering for the first time.

If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when. The city of Grand Junction has proposed two issues on the November ballot to combat the affordable housing crisis. Other interest dividends royalties and rental income are aggregated with other income and taxed accordingly.

If you do not usually send a tax return you can register for Self Assessment to declare any income you have not paid tax on from the last 4 years. May 02 2019 at 238 pm. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30.

EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. Applications received on or after 1 January 2013. Tax on your rental income will still need to be paid in Ireland.

The taxable income is 100 of the rental income. If a US Resident derives rental income from immovable property situated in India then the rental income will be liable to tax in India. Amendments in tax reliefs have been made this YA 2021 and some new additions have also.

Interest in government securities debentures and bonds. Worldwide rental income from the letting of private property is normally considered as capital income. You would declare your rental income pension income and shares income on your tax return.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Joint Center for Housing Studies at Harvard University. A 1 increase in the lodging tax and an 8 short-term rental tax.

Malaysia for the past six years. As for the pension this is paid to you gross but still taxable. In this case the rental income can be taxed at a fixed tax rate equal to 21 or 10 provided some conditions are met.

The net investment income tax. Find out whether you need to pay UK tax on foreign income - residence and non-dom status tax returns claiming relief if youre taxed twice including certificates of residence. According to the Income Tax Act 1961 the residential status of a person is one of the important criteria in determining the tax implications.

Stamp duty exemption of 50 on instrument of transferlease of landbuilding. This booklet also incorporates in coloured italics the 2023 Malaysian Budget proposals based on the Budget 2023 announcement on 7 October 2022These proposals will not become law until their enactment and may be amended in the course of their. Heres an example.

It will also send you a notice of its action along with the remaining 500 that was due to you as a tax refund. This exempts income that comes from overseas like rental of property or freelance work and also remote working employees of companies that are not based in the country. Youll need to fill in a separate tax return.

In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. Rental income other than house properties Gifts received. This is effected under Palestinian ownership and in accordance with the best European and international standards.

Short-term gains on such assets are taxed at the ordinary income tax rate. Instruments executed from 1 January 2013 to 31 December 2023. The rental income commencement date starts on the first day the property is rented out whereas the actual rental income itself is assessed on a receipt basis.

If you own rental real estate you should be aware of your federal tax responsibilities. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. The stamp duty and.

Americas Rental Housing 2020 Pages 1 and 7. TOP will deduct 1000 from your tax refund and send it to the correct government agency. Some investors may owe an additional 38 that applies to whichever is smaller.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Americas Rental Housing 2020 Page 7. Technical fee rental of movable property payment to a non-resident public entertainer or other payments made to non-residents which are subject to Malaysian withholding tax but where the withholding tax was not paid.

Under the Income Tax Act. Dividends received by individuals are exempt from tax effective from the 2008 year of assessment. Receiving further education in Malaysia in respect of an award of diploma or higher excluding matriculation preparatory courses.

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices. Tax Offences And Penalties In Malaysia. Do i declare in Malaysia in which may required to pay tax in malaysia.

State Laws on Landlords Access to Rental. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. For private property house the related expenses are deemed to amount to a standard amount of SEK 40000 and 20 of the.

Payment of rental or entrance fee to any sports facility. The incomes tax national regional and municipal the registration tax. You were going to receive a 1500 federal tax refund.

He has only visited his parents for a week twice a year during this time. Income derived by a resident from immovable property is to be taxed in the state where the immovable property is situatedEg. A company is tax resident in Malaysia if its management and control are exercised in Malaysia.

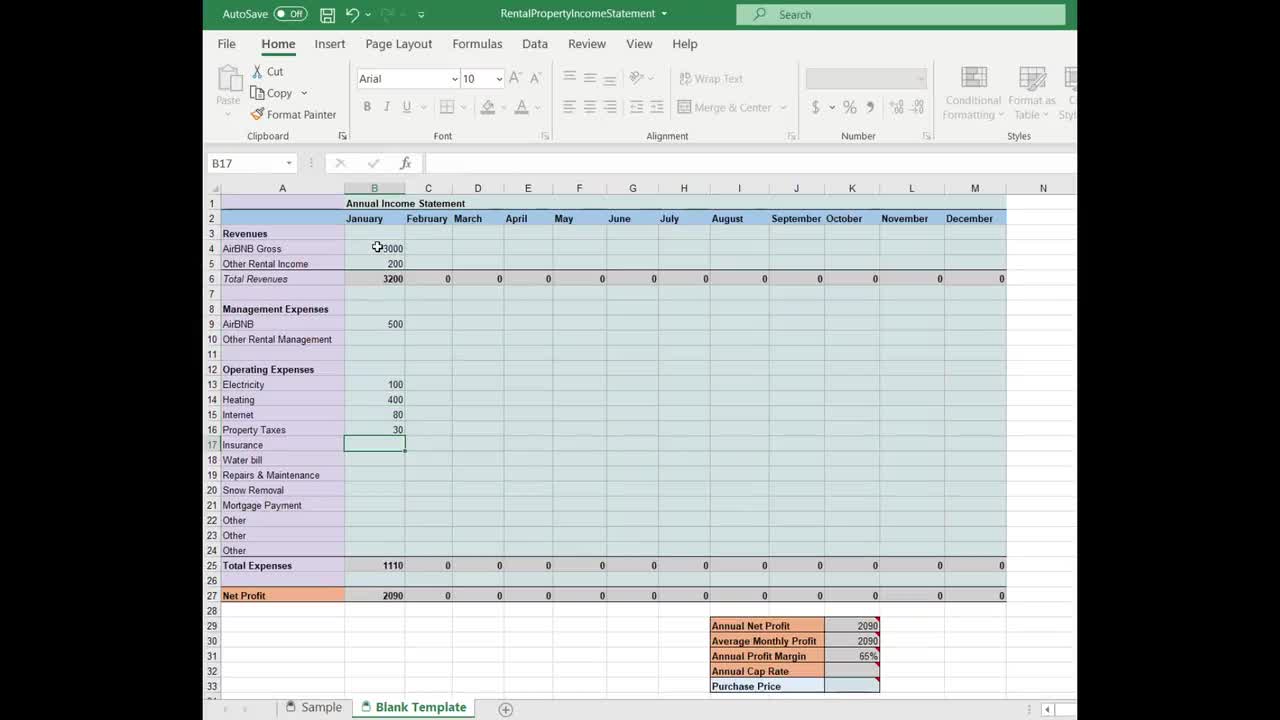

That means he has resided in India for 449 days in the past six years and the same. All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income. Remittances of foreign-source income into Malaysia by tax residents of Malaysia are not subject to Malaysian income tax.

Income Tax - Know about Govt of Indias Income tax guide rules tax efiling online slabs refund deductions exemptions calculations types of taxes FY 2022-23.

Real Estate Rental Income As Business Income For State Tax Purposes Deloitte Us

Computation Of Buss Income Computation Of Statutory Business Income For Ya Rm Net Profit Before Studocu

Income Tax Calculator 2020 Malaysia Personal Tax Relief Malaysia Tax Rate

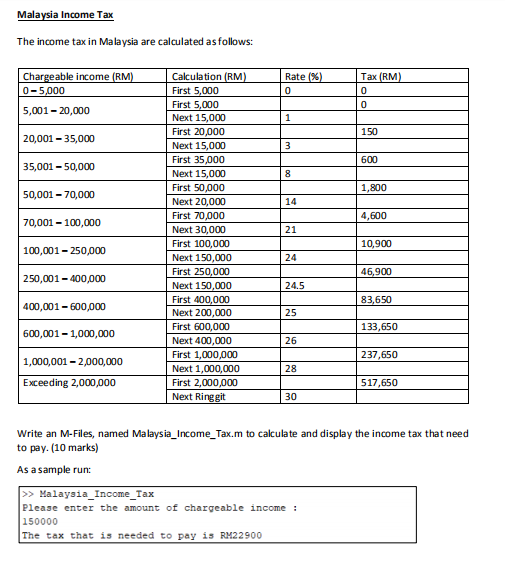

Solved Malaysia Income Tax The Income Tax In Malaysia Are Chegg Com

How To Declare Your Rental Income For Lhdn 2021 Speedhome Guide

Special Tax Deduction On Rental Reduction

Rise Of Rpgt And Stamp Duty Rate In Malaysia

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

E Filing Beginners Guide Q A Part 1 Income Tax Malaysia 2022 Youtube

Rental Income Tax Malaysia 2019 Madalynngwf

Rental Property Is Now The Right Time To Sell

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

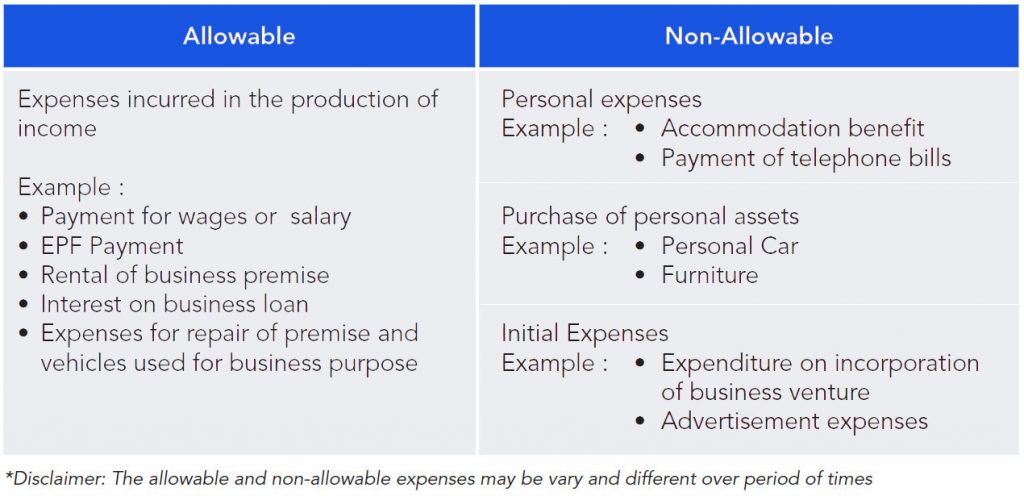

Understanding Tax Smeinfo Portal

Sept Dec 2017 Q Qqqqqqqqqqqqqqqqqqqqqqqqqq Professional Level Options Module Advanced Taxation Studocu

Avoiding Rental Income Tax Pitfalls In Malaysia

Taxplanning What Is Taxable In Malaysia The Edge Markets

Comments

Post a Comment